It’s finally getting interesting out there. I’ll share some thoughts on the broader macro picture in a separate post, as the current economic environment is rife with the types of irregularities, inconsistencies, and aberrations you would expect given the degree of current fiscal and monetary intervention.

At the moment, the broader equity markets have finally started to exhibit the fatigue one would expect following the historical rally off the October lows, especially given the lack of synchronicity in other assets (that we have been highlighting). At some point, big tech – i.e. MAG7 and semis – can/could/will/would no longer go up unabatedly on 0DTE call options at ever expanding volatility presumptions. That’s what has happened so far over the past few sessions. How much further we go is very much to be determined.

We’ll touch on equities last this time…

Interest Rates

At the beginning of the year, I highlighted ~4.40% (38% fib retrace) as initial support for 30 year USTs and ~4.55% (50% fib retrace) as the next area of support. Last week’s surprisingly hot CPI report took us through 4.40% and bulls have been unable to break back down. Gut tells me we’re going to test 4.50-4.55% in the coming sessions, but if we do, that should be a really solid risk/reward from the long side.

Commodities

Gold is still meandering and looking for direction, almost exactly in the middle of the quadruple top at ~$2075 and the 200 day moving average (MA) at ~$1965. From a macro perspective, the fundamental picture for gold remains strong – egregious US fiscal deficits, an FOMC leaning towards accommodation once inflation/employment gives them an excuse, and a volatile geopolitical environment. Technically it looks like it’s basing for a major move higher (note the daily MACD has reset and is curling higher), but we’re in no man’s land at the moment. So we wait.

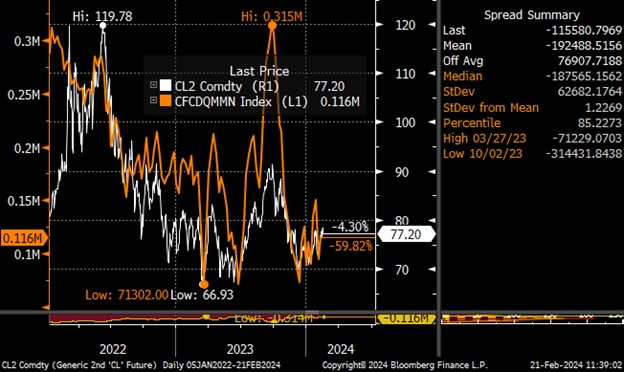

Oil, meanwhile, is starting to look a little bearish… 1) we have a potential head and shoulders formation developing (not usually my favorite technical structure, but it’s there); 2) the daily MACD is curling down and just seems tired from trying to go up without much success; 3) $80/barrel seemingly cannot be broken and the 200 day MA is retaining its superiority; 4) despite all of the geopolitical turmoil, oil cannot break up and out. Our one hesitation is investor positioning is currently low (orange line on the CFTC chart) and comparable to previous price lows in 2023. Bias would be to short it as long $80 isn’t convincingly broken to the topside, but the potential for geopolitical gap risk makes this tricky.

Equities

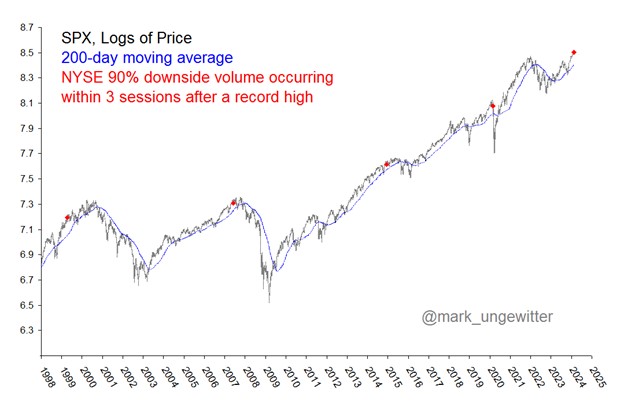

I’ve been harping on divergences for weeks as an indication we were getting close to topping. One has been the lack of breadth in the rally the past handful of weeks, with the vast majority of gains driven by MAG 7, semiconductors, and maybe financials. For some reason this chart spoke to me in a similar but different way:

https://twitter.com/mark_ungewitter/status/1757530467295777132/photo/1

Days with 90% down volume only a few days after a new all-time high simply don’t happen in raging bull markets with strong participation across sectors. Worth highlighting previous red dots on this map occurred in the runup to recent Presidential election years – notably 1999/2000, 2007/2008, and 2020.

I’ll note the continued diveregences in the McClellan Oscillator – note the red crossing arrows at the price lows in September/October, showcasing positive momentum despite lower prices. We now have the complete opposite (green arrows). Eventually it will matter – it always does.

Technically, the S&P 500 is sitting on relatively strong but also precarious support at ~4950. Below 4950 likely sees a test of 4900 and likely locks in the highs at ~5048 for the balance of the quarter. The 50 day MA (currently ~4830 and rising) is a logical first target, any subsequent break could easily run towards ~4600. Markets don’t even think about getting longer-term bearish unless we break support at the 200 day MA for a sustained period of time, which I consider improbable at the moment.

In the very near-term, it’s all about NVDA earnings tonight. We could easily rally back to new highs on AI jubilation from one company after nearly every other S&P 500 company has reported.

But for the balance of the quarter, we’ll give bears the edge.