As we start a new year, the act of putting up a new wall calendar (yes, I still use one) and a change to how we write “01/xx/24” on a signature block always gives market prognosticators an excuse to predict 2024, as well as reflect on 2023.

Many missed the boat on the bull run to start 2024, the ridiculous MAG7 performance, and the unrelenting sprint higher into the end of 2023, so forgive me if I share a tremendous amount of skepticism regarding prognostications.

I shall not fall into the same trap, but instead point out some observations across markets that are worth highlighting… and I will endeavor to do this far more frequently in 2024.

Firstly, I am shocked by how few analysts have come up with a reasoned explanation for the US economic outperformance in 2023, both on an absolute basis and relative to the rest of the world (“ROW”). China never bounced, despite consistent expectations that they would, Germany’s export machine struggled mightily, much of the EU continent was flat at best, and most of the commodity producing countries suffered from the ebb and flow of violent market volatility and inflation.

The US? Reasonably buffered, especially considering the severity of the interest rate hiking cycle. Know why? It’s actually really simple.

Trillions in fiscal deficits. $1.5+ trillion alone last year, ~$600 billion more than pre-COVID 2019.

Source: https://bipartisanpolicy.org/report/deficit-tracker/

While every other country in the world has to attempt at least some semblance of a balanced budget in order to avoid bond and/or currency vigilantes, by and large, the United States has enjoyed unparalleled freedoms to print ever expanding monetary deficits for decades. And while I expected a split Congress in 2023 would provide some modicum of fiscal restraint, that simply didn’t happen… at all. It was the single biggest factor in 2023 that I did not appreciate but absolutely explained the resiliency of the US labor market, consumer, and thus broader markets – massive transfer of payments from the public sector to private. That alone will not provide the same resiliency in 2024, for any number of reasons we’ll highlight in the coming pages, but it did last year. We are setting ourselves up for an enormously crushing bear market later this decade, but it is hard to imagine that accelerating into 2024 absent a true exogenous shock – e.g. China invading/blockading Taiwan.

So while the fiscal stimulus will provide a buffer for markets in 2024, I maintain that 2024 will be a bumpy landing – not hard, not soft, but certainly a combination of the two, and at varying times and degrees.

A few other thoughts the charts on the following pages will touch on:

· Within equities, the beginning of 2024 seems likely to be one of rotation out of MAG7 and into unheralded assets, notably defensives and potentially small caps and financials. We like defensives to start the year and think they should provide the appropriate buffer, but are more than convinced financials and small caps will have a much harder go of it than most believe.

· The underlying structure of the market has changed far more than the average person can believe due to the advent and adaption of the 0 DTE options market in many underlying indexes… as in, zero days to expiry. The implications are enormous to market stability in ways that haven’t been tested yet, but the reality is this: on any given day, any investor can go long or short 100 shares of a stock or an index worth hundreds of thousands of dollars by buying 1 put contract and spending a fraction of that notional. While it doesn’t happen often, when the herd gets on the same side of the trade, it obviously exacerbates volatility. We’ve seen snippets of it – the unrelenting November/December rally had 0 DTE contributions embedded from the call side, as did the December 20 “mini-flash crash” from the put side. This is a far more destabilizing force than many believe, and eventually something big is going to happen and we’ll see a spectacular crash that will immediately be blamed on 0 DTE. Not sure if it’s in 2024 or 2025, but it’s going to happen. Just wait.

· Precious metals (i.e. gold and silver) are likely going to benefit again in 2024 as a safe haven and alternative to fiat currency, but we expect the bouts of volatility that plagued gold and silver in 2024 will continue. Higher highs and higher lows should be the theme of 2024.

· Crude oil is increasingly becoming both a strategic asset and a depleting resource. As such, at some point in 2024 or 2025, oil is going to embark on one of the most dramatic bull market runs we have ever seen… not sure where from or where to, but I’m expecting something along the lines of a double in the price of oil in a short period of time (i.e. weeks not months). Geopolitics will be the trigger, but an absence of investment in homeland production and an increasingly anti-US perspective amongst the major oil producing countries will hamper a ramp up in supply needed to offset the price spike. It’s coming too.

· Interest rates… my biggest annoyance of 2023 because my macro thesis was so spot on and I executed on it so poorly. I was a screaming long whenever the 30yr UST tagged 5% and conditioned myself to simply get long and sit tight until we rallied to at least 4.50%, then start reducing positions. Needless to say, I took profits entirely too soon… and we tagged 4.00%. A long bond between 3.50% and 4.25% for the vast majority of 2024 seems about right.

On to the charts…

Equities

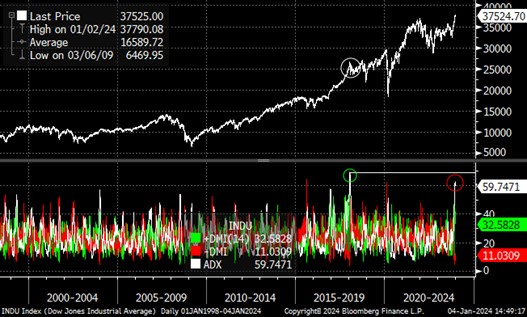

The end of December 2023 / early January 2024 DMI readings on the DJ Industrials were the 2nd highest in recent history, ranking behind only January 2018. Q1 2018 saw a material correction before making new highs in September ahead of Federal (though not Presidential) elections. Not saying the second part of that equation will definitively happen, but history suggests it’s more likely than not.

XLF similarly is historically overbought, rivaling the bear market bounce in July 2008 and the post-Trump election euphoria in November/December 2016. The rally of late is far more surprising to me considering the fundamental challenges facing the financial sector in 2024 – deteriorating asset quality (consumer and commercial), likely lower NIMs (as the FOMC cuts rates), challenging liquidity dynamics… also note the diagonal pattern playing out into the highs, ahead of Q4 earnings season (starting on Friday). This will likely be one of our favorite shorts throughout the year.

Momentum divergences were a big tell at the end of the year that the rally in December was entirely driven by performance chasing, short squeezes, and pure momentum. Notice how from August to October, every time a new S&P 500 price low was made (orange line), the McClellan Oscillator (white) made a higher low – waning momentum and positive divergence is one of the strongest technical indicators that a change in trend is imminent. Same thing happened in November/December, just in the opposite direction – four subsequent price highs met by lower momentum, culminating on December 28.

Interest Rates

30 Year USTs found support at ~5% and showcased the type of positive divergence seen at market inflection points (previous ranges highlighted include 2003-2004 and 2017-2019), and then rallied 100bps in 2 months to the psychological 4% barrier. It seems sensible to us that we’ll see 30s range bound between ~3.50% and 4.40% for much of 2024, barring economic/geopolitical shocks or an inflationary spike. In the near-term, 4.20-4.25% is important support, a move higher could take us comfortably toward the 4.40% level where we would likely be buyers with both hands…

Energy

Despite all of the geopolitical turmoil, blockades in the Red Sea, SPDR refills, and Saudi Arabia steadfastly cutting production in order to achieve $90+/barrel oil, energy simply cannot rally. $65 +/- for WTI has been both strong resistance and support for many years (red line on chart) and with the daily MACD on the verge of rolling over, the market way wish to test the Saudi’s willingness yet again… and if energy can’t rally, what does that say about global demand and the likelihood of economic recessions in 2024? At some point, energy will be a phenomenal long in 2024, but it doesn’t appear that now is the best of times.

Here’s to an exciting, enjoyable, and profitable 2024!