I wrote this a few weeks ago in my 2025 Outlook (I bolded/underlined a few points for emphasis):

There is one distinctive trend that I have increasingly noticed across assets recently that has me quite concerned as we move into a higher risk economic environment later in the year: the exacerbation of price movements. In the investment world that we live in now – comprised of 0DTE options, algorithmic strategies, and increasing access to high leverage, low notional investment strategies – the markets exacerbate and exhaust more so now than we have ever seen before…

THIS IS NOT HEALTHY BEHAVIOR.

You could certainly blame some of the December moves on illiquidity during the holidays, but not this activity in January when everyone is back at their desks. This is simply not healthy and constructive behavior in arguably the most liquid equity market in the world. And this still pales in comparison to what we saw in August last year with the JPY shock, which to me was a harbinger of what’s coming…

2025 is going to be a trader’s market.”

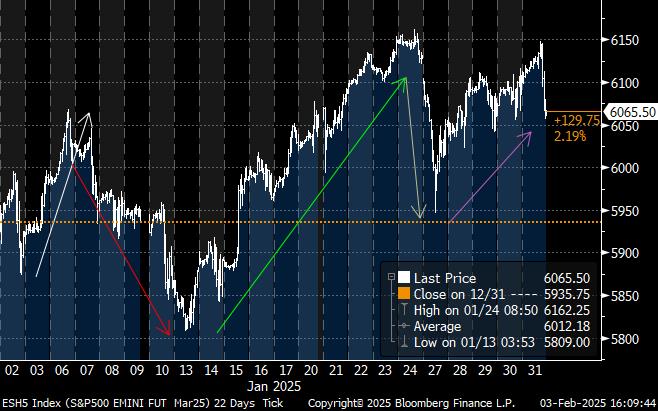

There were 22 trading days in the first month of the trading year. With regard to the March S&P futures, do you know how many of those trading sessions had almost a 100 point difference between the high of the day and the low of the day?

14.

That means roughly 2/3 of the January trading days had more than a 1.5% move between the low of the day and high of the day. It looked like this.

What’s even crazier is if you look at these multi-day swings…

- 1/2-1/6 – 3.4% up

- 1/6-1/13 – 4.3% down

- 1/13-1/24 – 6.1% up

- 1/24-1/27 – 3.4% down

- 1/27-1/31 – 3.3% up

Now look at Nvidia, what not long ago was the largest market cap stock in the world.

- 1/7-1/13 – 15% down (off the all-time high)

- 1/13-1/24 – 15.5% up

- 1/24-1/31 – 19.5% down

Now imagine you were trading Nvidia via one of the leveraged ETFs – e.g. NVDL or NVDU. These are multiple 30-40% moves in the largest market cap stock in the world in the first trading month of 2025. None of them were earnings related.

Do I have your attention now?

This isn’t just happening in S&P futures or NVDA, it’s happening everywhere. Look at crypto, gold, oil, FX, US Treasuries, anything, and you’ll see the rapidity of the moves occurring in every single market.

You can blame tweets and tariffs and economic data all you want, but “news” is simply the excuse. These extenuating and exhausting moves are a function of market structure, and one that is increasingly unhealthy and inherently very unstable.

In my very strong opinion, 2025 through the remainder of the decade is going to be about capital preservation and protection, as well as taking advantage of misalignments in assets when they happen. These more frequently occurring exhaust patterns are the main technical reason I feel that way, I outlined many of my macro reasons in last month’s outlook.

For all of those reasons, I am excited to be starting a different fund in the coming weeks that will have this Protection theme be its very thesis. I fully expect there to be enormous opportunities in the markets in the coming years, but I also believe in an equally enormous “sleep at night” benefit from being in a vehicle such as this.

A few other thoughts to end:

- I think oil in the high $60s / low $70s will be the lows for the coming months.

- I said this in my outlook a few weeks ago: Honestly, it wouldn’t surprise me if the ~5.00% yield we saw in 30s earlier this week turns out to be the high of the year. Still feel that way.

- Long USD is a very crowded trade at the moment, though I’m not quite certain when that switch flips this year. But it’s coming.

- I still think the S&P 500 trades much higher in the coming months before ending much much lower later in the year.