With rare exception, divergences are a key requirement at longer-term inflection points – both tops and bottoms. The most relevant divergences occur across indices, other assets, advance-declines, and momentum. The more powerful the divergences, the greater the likelihood of the significance of the top or bottom.

We’re increasingly approaching that type of powerful inflection point. Current divergences may simply portend a reasonably brief and modest correction before more new highs. But this relatively relentless rally since October is getting quite long in the tooth.

The price highs in December were highly unlikely to be “the” price highs for the major indices, simply because momentum was so strong (see my January 8 post with regard to INDU momentum) and nearly all indices and assets were in sync – i.e. the S&P 500, NASDAQ, Russell 2000, 10 year USTs, USD all made relative price highs/lows on December 28.

Fast forward a few weeks to new highs in the S&P 500 and NASDAQ, and how have some of those other assets performed?

· Russell 2000 – down ~4% YTD

· 10 year UST prices – down ~3% YTD

· NYSE Composite – down ~2% YTD

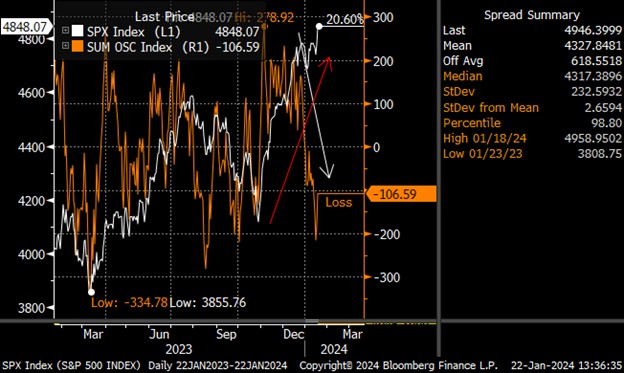

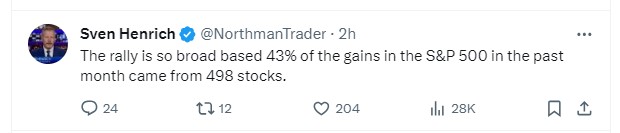

Beyond those cross asset divergences, we’re seeing divergences in volatility (higher lows and higher highs), advance-decline volume, and the McClellan Oscillator… which printed a number below zero on Friday 1/19 when both the S&P 500 and NASDAQ made new highs for the year. Not sure that’s happened before.

And this is all happening while China’s markets (including Hong Kong) are crashing, to the point Chinese authorities are tightening regulations around short selling and considering hundreds of billions of dollars worth of rescue packages for the stock market.

By no means do these divergences ensure prices are going to decline immediately, but it does mean the next correction may not be as simple as “BTFD.” Caution is certainly warranted up here.

Equities

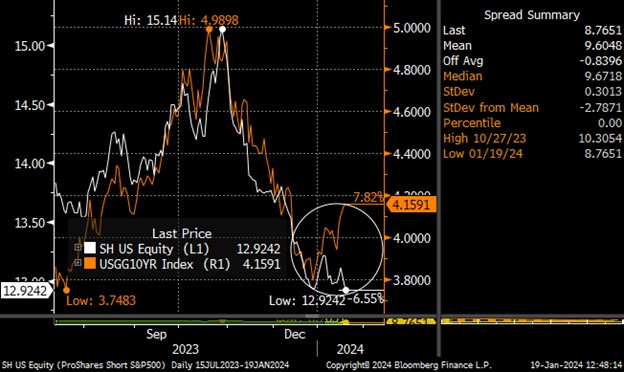

I’ll let the charts do the talking, since in many ways they are self-explanatory. Note the consistency of the momentum (MACD) divergences and the disparate performance across assets.

This chart is the inverse price of S&P 500 vs 10 year UST yields.

Interest Rates

Last update noted:

“30 Year USTs found support at ~5% and showcased the type of positive divergence seen at market inflection points (previous ranges highlighted include 2003-2004 and 2017-2019), and then rallied 100bps in 2 months to the psychological 4% barrier. It seems sensible to us that we’ll see 30s range bound between ~3.50% and 4.40% for much of 2024, barring economic/geopolitical shocks or an inflationary spike. In the near-term, 4.20-4.25% is important support, a move higher could take us comfortably toward the 4.40% level where we would likely be buyers with both hands…”

Well, we touched 4.40% on Friday and rallied. Bond bulls need to hold that level or next line of defense is north of 4.50%.

Commodities

WTI is compressing for a big move in the coming days/weeks. We’re pretty confident in either $80+ or <$70 in the next few weeks, and maybe both before the end of Q1. In all likelihood, it depends on which way the geopolitical winds blow. Global demand clearly doesn’t seem supportive of higher prices, so it requires some supply manipulation, disruption, and/or fear to get us there.

Happy trading.